STEEL-IN-BRIEF April 17

STEEL-IN-BRIEF April 17

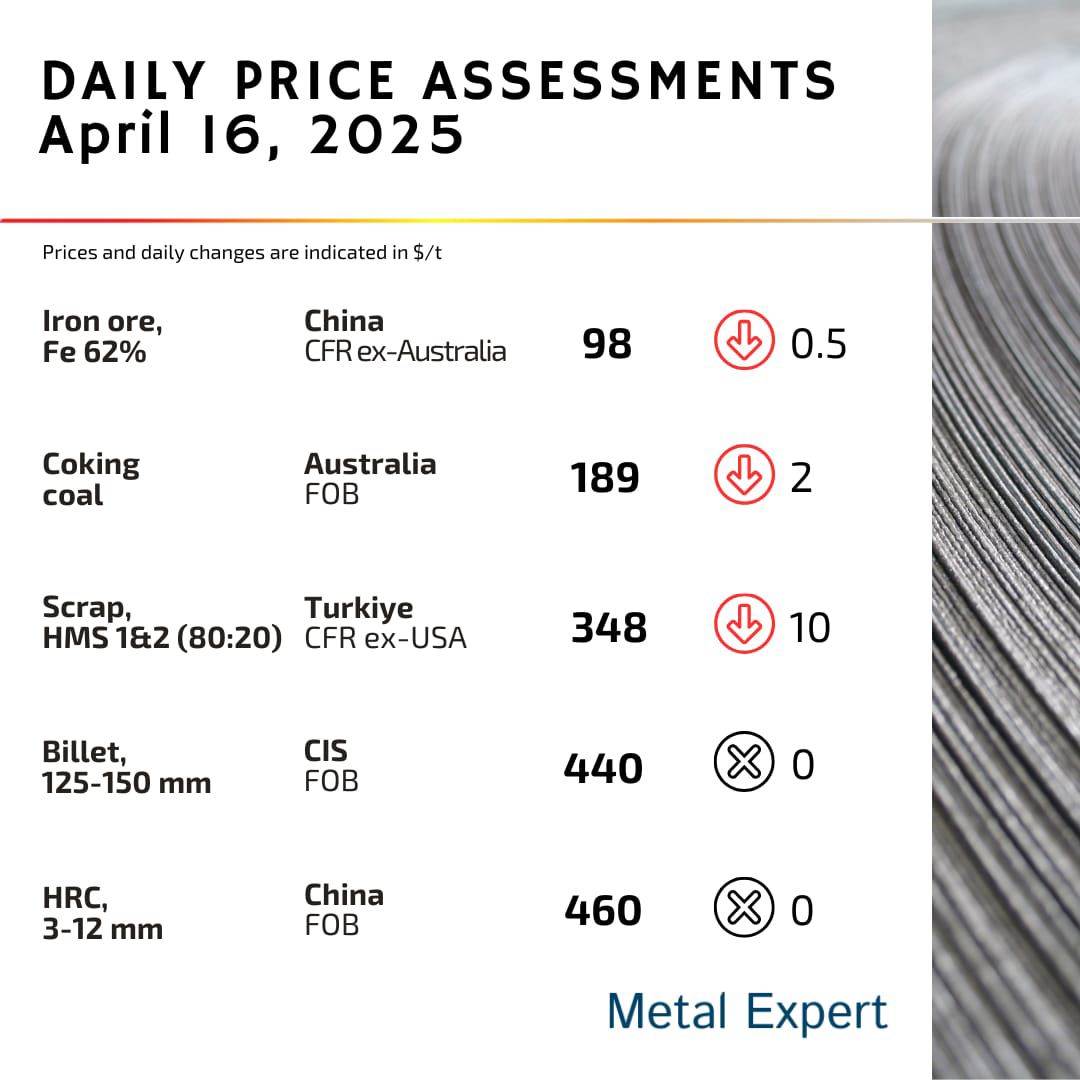

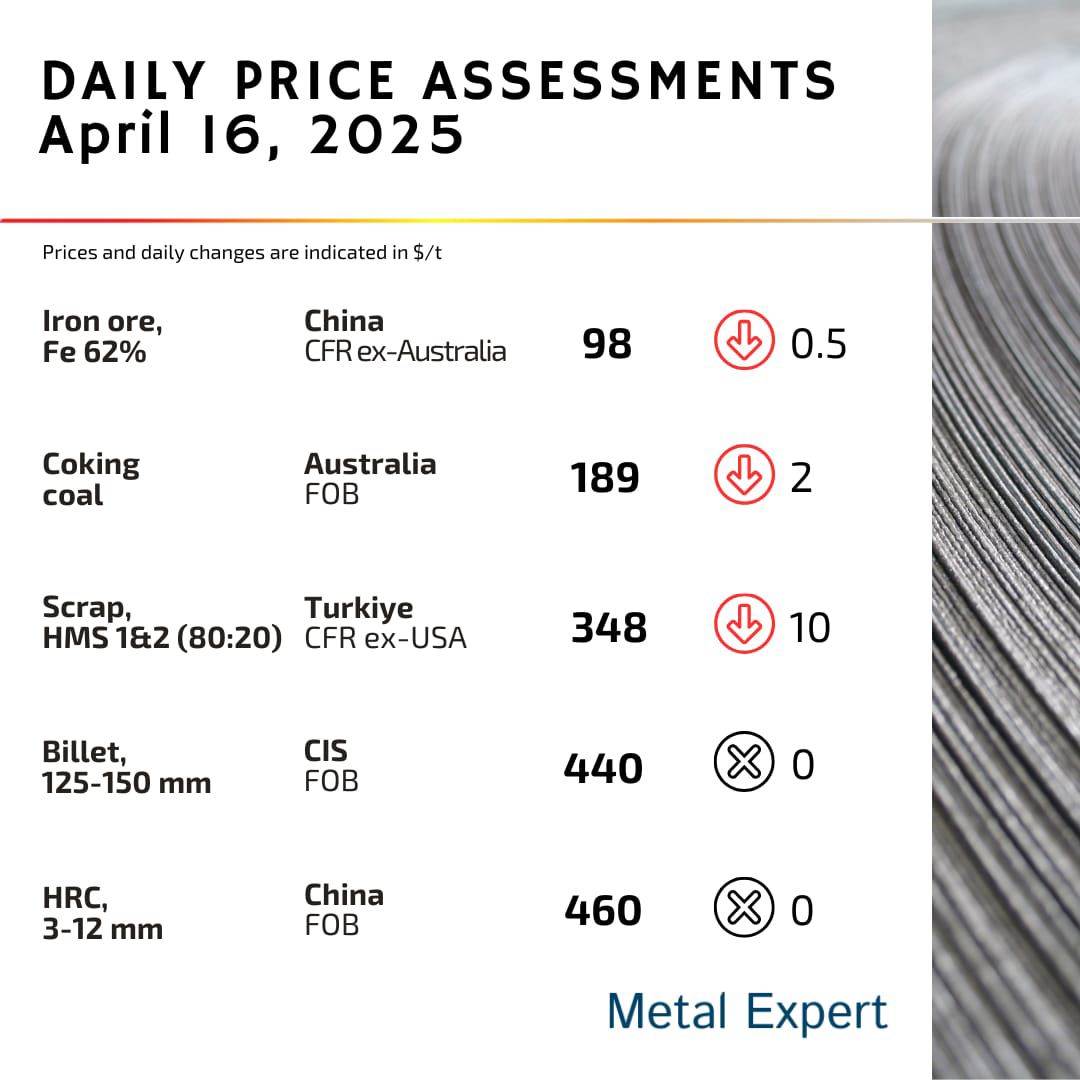

Australian coking coal prices edged down by $2/t to $189/t FOB on April 16 after a 40,000 t tender for Goonyella coal closed at that level. Despite the slight drop, demand remains supported by ongoing supply concerns due to mine suspensions. A 75,000 t offer at $187.5/t FOB was later withdrawn. Market activity improved from March, though sentiment remains cautious amid uncertainties, prompting some buyers to secure stable supply.

Australian iron ore fines 62% Fe went down by $0.5/t to $98/t CFR amid weak market sentiment. The drop was driven by disappointment over China’s lack of expected stimulus and renewed US-China trade tensions, including sweeping 245% US tariffs. Despite strong Q1 GDP growth in China (5.4%) and rising steel output, market uncertainty and slowing trading activity weighed on prices. Output cuts from Rio Tinto and Vale provided some support.

Vale’s iron ore sales rose 3.6% y-o-y in Q1 2025 to 66.1 million t, despite a 4.5% drop in production to 67.7 million t due to heavy rainfall and maintenance. Strong output at S11D and supply chain flexibility supported sales. Pellet production fell 15.2%. The average iron ore fines price declined to $90.8/t from $100.7/t a year ago, mainly due to lower premiums. Progress continued on the Vargem Grande 1 and Capanema projects, aimed at boosting long-term capacity.

Rio Tinto’s iron ore production fell 10% y-o-y to 69.8 million t in Q1 2025 due to severe weather and four tropical cyclones in Western Australia, cutting shipments to 70.7 million t. The miner now expects full-year sales at the lower end of its 323–338 million t guidance. Mitigation plans aim to recover half of the 13 million t lost. Meanwhile, portside sales in China rose 32% y-o-y. Key growth projects in Western Australia and Guinea remain on schedule.

Asian billet market sentiment turned bearish again amid escalating US-China trade tensions and weak demand. Indonesian billet offers dropped to $430/t FOB, while Chinese 3sp semis remained at $425–430/t FOB. Offers to SE Asia fell to $445–450/t CFR, with demand nearing zero due to regional holidays. A reported deal for Chinese 5sp billet at $440/t CFR Manila remains unconfirmed.

China’s crude steel output rose to 92.84 million t in March, the highest since May 2024, up 4.6% y-o-y, despite Beijing’s pledge to cut production. Q1 output edged up 0.6% to 259.33 million t. The increase was driven by improved margins, with Tangshan billet profits reaching RMB 100/t ($13.9/t). Lower inventories and stimulus hopes boosted sentiment, though the surge contradicts government plans to cut annual output by 50 million t starting this year.

Canada will allow automakers to import a limited number of US-assembled, USMCA-compliant vehicles tariff-free, provided they maintain production and investment in Canada. The move, announced on 15 April, offers relief to firms like GM and Stellantis amid escalating US-Canada trade tensions. It follows reciprocal 25% tariffs on steel, aluminium, and vehicles after the US imposed sweeping duties. Reduced production will lower tariff-free import quotas under the new performance-based scheme.